The advantage lowers your interest level but isn't going to transform the quantity of your monthly payment. This advantage is suspended throughout durations of deferment and forbearance. Autopay is not needed to get a loan from SoFi.

Not like direct subsidized loans, unsubsidized loans can be found to both of those undergraduate and graduate or Specialist degree students. To become eligible, borrowers should be enrolled not less than aspect time at a faculty that participates during the direct loan application.

On the subject of student loans, people usually request us: What’s the difference between subsidized vs. unsubsidized loans?

Comprehending Grad PLUS Loans is crucial as they offer money support to graduate and Expert students searching for Sophisticated levels.

Unsubsidized Loans: Unsubsidized loans offer increased borrowing limits, producing them suited to students who should go over a good portion in their academic bills further than what subsidized loans can offer.

When you've got chosen a school, Stick to the Guidelines within the economic help offer you or question the monetary aid Business. In case you’re however applying to faculties or looking forward to, hang restricted till you decide on a school.

You can find various application processes to abide by, based on which type of student loan you’re trying to find.

Dependent vs. Impartial Position: Your dependency status might also effect your eligibility. Dependent undergraduate students may have diverse borrowing limits than independent students, so it’s significant to be aware of your standing.

Even though the businesses we selected in the following paragraphs consistently rank as getting some of the sector's reduced interest prices, we also compared Each and every business on the next features:

Forgiven amounts underneath PSLF are not taxable, but amounts forgiven below IDR programs are regarded as taxable earnings. Borrowers must understand the precise situations and tax implications of those Student Loan Forgiveness courses.

Apply directly on the website. You’ll be requested to decide on the sort of repayment alternative and interest level variety you wish.

A Graduate PLUS Loan operates by giving financial assistance to website graduate or Qualified students enrolled at least fifty percent-time in a qualifying degree method.

All federal loans also include an origination payment, which can be taken through the loan just before it’s disbursed to The varsity. The origination fee for all subsidized and unsubsidized federal loans is one.057%**.

Private loans don’t possess the exact protections and repayment choices as federal loans, for example loan forgiveness and deferment.

Tia Carrere Then & Now!

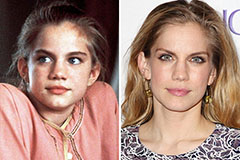

Tia Carrere Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now!